Property guarantee range features a predetermined interest rate along side lifetime of the loan. However are going to pay a higher rate, especially in advance. An excellent HELOC get a highly low rate at the start and you will often have attract only repayments. Just make sure you are from the right financial situation later about financing identity to manage the fresh payments in the event that rates increases.

5. HELOC Rates Are generally Below College loans

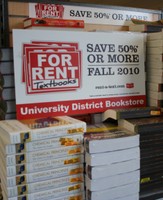

If you want to purchase educational costs, as opposed to taking out a school loan, you may also make use of HELOC. It is hard to conquer the interest rate off a house financing because it’s protected by the home. Ask lenders and agents once they provide a beneficial competitively priced domestic equity line of credit which have bad credit.

HELOC loans are getting quite popular once again; individuals are earning extra money and possessions opinions are on the latest way-up. There are many reasons so you can tap the latest equity in your house or apartment with a house guarantee line that have lowest borrowing. Talk to your bank in the opening good HELOC loan having an effective or borrowing from the bank now. Non-Best Loans and Lines of credit for all kind of Credit

Less than perfect credit HELOC Shows

- Transfer HELOC to Repaired Price Mortgage

- Combine Highest Lines of credit and you will HELOCs which have Most useful Cost

- Earlier in the day Bankruptcy proceeding Ok

- Later Repayments Okay

- Series Ok

- Low Fico scores Okay

Solid dedication to customer care. Of many people discovered spirits towards fixed rate next mortgage loans that always has straight down rates as compared to changeable cost you to definitely Best is set on. Summation, now the fresh new costs is lower to the fixed price second mortgage loans than he or she is into house security traces. Very, the full time didn’t be better so you can secure towards a detrimental-borrowing from the bank second financial and also a fixed price which enables you to become obligations free shorter.

For those who have fico scores lower than 600, enquire about non-qualified mortgage loans. Repaired rates second mortgages will let you budget convenient since your percentage is the identical each month.

Is it possible you refinance a beneficial HELOC?

Sure, you could refinance HELOCs and you will house collateral money, just like you create re-finance your residence financing. After you refinance a beneficial HELOC you are settling your residence guarantee line harmony and you will replacing they with a brand new HELOC that enjoys brand new interest rates and you may conditions. Most people will refinance HELOC whenever their draw several months concludes therefore that they can move it to help you a predetermined rates house equity financing having repaired monthly premiums. spending it well totally as a result of a money-out re-finance, otherwise having fun with funds from a predetermined-price household guarantee financing.

Exactly what can you use an excellent HELOC to have?

Borrowers can use money from a home equity credit line to possess debt consolidating, household renovations, design, education, new business start-ups, real estate financial investments and more. Of a lot property owners remove an excellent HELOC to own in case there are a crisis also.

What is the difference in family guarantee financing and you may HELOC?

Home security money and HELOC credit lines are distinctive line of version of loans centered https://www.elitecashadvance.com/personal-loans-mo on good borrower’s guarantee in their home. Our home security loan that have poor credit are amortized with repaired monthly obligations and a fixed interest rate for the whole duration of your own financing. While, the brand new HELOC is an excellent revolving lines of credit with adjustable interest levels, leading to minimum percentage which is noticed an interest simply commission that’s die monthly when you look at the mark months. Having a great HELOC, the fresh new borrowers can also be withdraw funds from their lines of credit so long while they create notice repayments. Find out about the differences anywhere between a property guarantee loan and you will credit line. When you find yourself consolidating personal debt and then have viewed your credit history and you may understand your own credit ratings are reduced, i recommend and you can equity loan that have less than perfect credit as you get a fixed payment and a fixed interest that’s closed on lifetime of the borrowed funds.