Due to the fact an officer, your dedicate yourself in order to offering and you may protecting your society. If you’re considering homeownership, it is critical to comprehend the procedures employed in being qualified getting good home loan particularly customized on the needs off law enforcement gurus. Inside step-by-step guide, we’ll take you step-by-step through the procedure of protecting a house financing as the a police, ensuring you happen to be really-ready to take that it high part of your daily life.

- Begin by examining your credit score and handling people problems that might negatively effect the loan software. Pay-off outstanding costs, best errors on the credit report, and continue maintaining a great commission record.

- Loan providers generally want certain data files to possess loan acceptance. Due to the fact an officer, you may need to provide even more papers, such as for example evidence of a position, pay stubs, taxation statements, and any additional earnings sources. Assemble these types of data ahead of time so you’re able to streamline the application procedure.

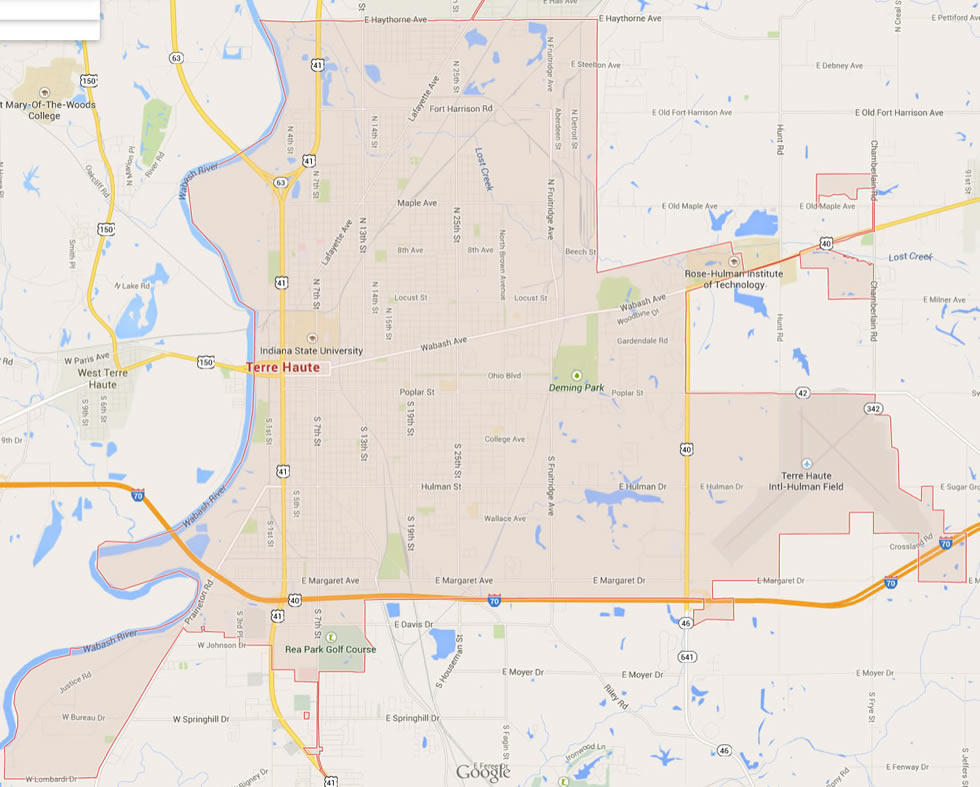

- Talk about the different financial programs readily available specifically for law enforcement officers. This type of applications may offer benefits such lower rates of interest, flexible down-payment choices, or deposit direction. Research condition-specific applications like the the police home loans inside Tx and see if there are any nearby efforts or gives readily available to have law enforcement officers.

- Think providing pre-recognized for a home loan before family query. Pre-acceptance suggests sellers you are a significant visitors and certainly will improve your settling updates. Talk to a reputable Denver large financial company experienced in working with cops in order to browse the brand new pre-recognition procedure smoothly.

- Look at your financial situation and find out an authentic budget for your home purchase. Consider not only the loan repayments and most other homeownership will set you back like possessions taxes, insurance policies, and you may repairs. Manage an intensive monetary plan to be sure you can also be conveniently pay for your ideal household.

Remember, partnering that have a good Denver large financial company proficient in coping with police officials also provide worthwhile suggestions and you will easy loans Copper Mountain CO support in the mortgage app techniques

Conclusion: Protecting a mortgage as the a police officer means careful preparing and you will understanding of the fresh qualification processes. From the examining your credit rating, event necessary records, researching loan applications, getting pre-acknowledged, and you will creating a resources, you’re going to be well-willing to browse the way so you can homeownership.

Because you continue it fascinating trip, keep in mind that Bluish Arrow Credit focuses on helping laws administration experts having lenders. Contact them today to receive custom information and you can talk about a knowledgeable mortgage solutions to possess police officers.

Think of, partnering that have a Denver mortgage broker experienced in working with cops officials also have rewarding advice and assistance on mortgage app procedure

Conclusion: Securing home financing because the an officer means mindful preparation and you can knowledge of brand new qualification procedure. From the examining your credit score, collecting expected paperwork, comparing mortgage apps, providing pre-accepted, and you will creating a spending budget, you’re going to be better-happy to browse the road so you can homeownership.

Since you embark on which enjoyable travels, just remember that , Bluish Arrow Financing specializes in helping law administration pros that have home loans. Making use of their experience in Texas, Tx, and you will Florida, they are aware the particular need regarding law enforcement officers and supply individualized service customized so you can the authorities lenders and you can home loans having law enforcement officers. Get in touch with Bluish Arrow Financing today to discovered individualized advice and you may discuss an informed home loan solutions to possess cops.

- Exploring Lenders to have The authorities Masters in Colorado:

- Discussing Colorado’s efforts getting cops, like the Administrator Next door system

- Report on most readily useful mortgage brokers when you look at the Tx, targeting their knowledge of the police lenders

- The fresh new role away from a Denver large financial company inside securing an educated home loan alternatives

Conclusion: Law enforcement lenders unlock gates so you can homeownership getting police officers which serve and you can protect our communities. When you’re looking exploring the better mortgage brokers and you can Denver mortgage brokers proficient in law enforcement mortgage brokers, look no further than Blue Arrow Financing. Employing experience in Tx, Tx, and you will Fl, capable help you in protecting the ideal home loan designed toward demands because the a police or the authorities elite.

Think of, because you go on your own journey on the homeownership, its vital to talk to professionals devoted to law enforcement house financing. Get in touch with Blue Arrow Lending today to explore your options or take a step closer to realizing your own homeownership fantasies.